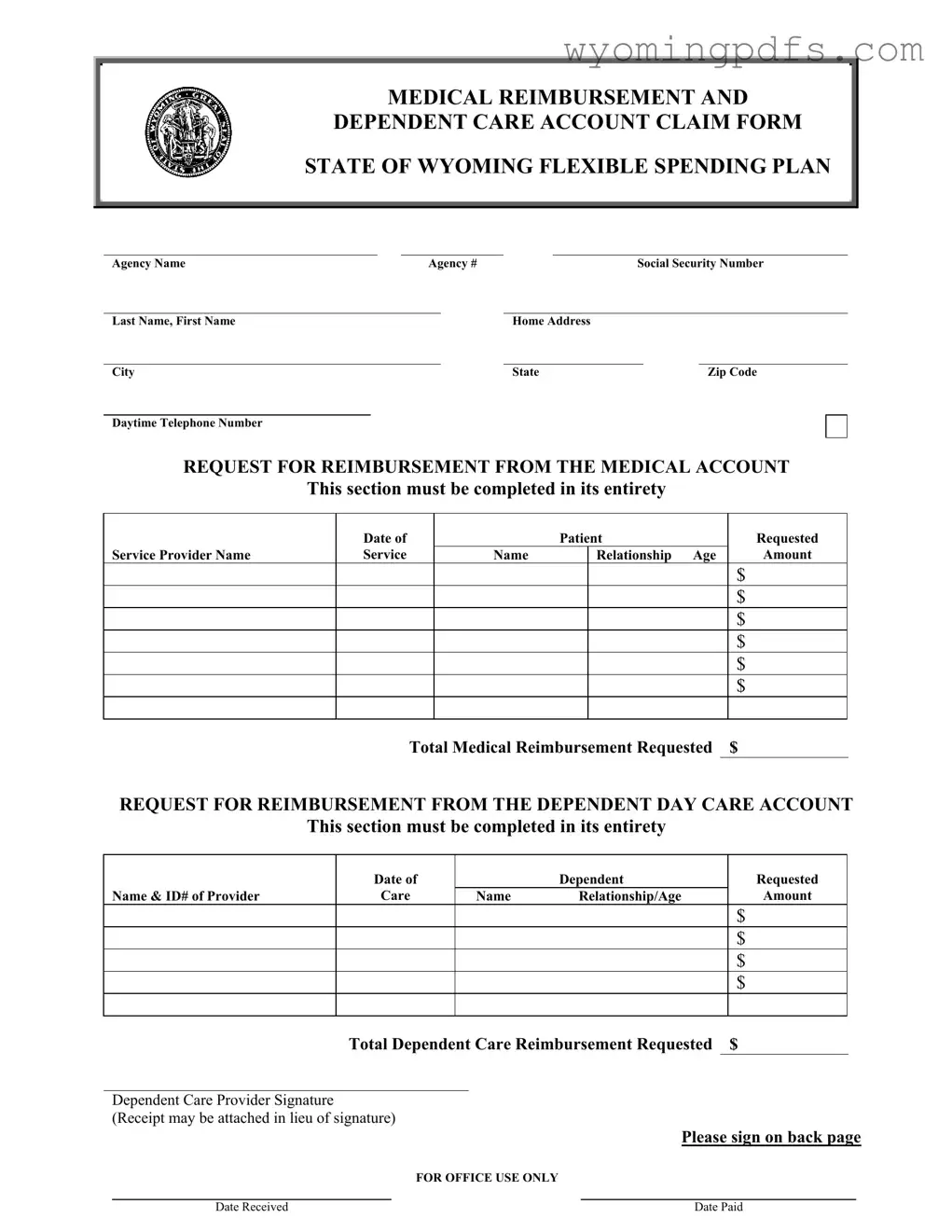

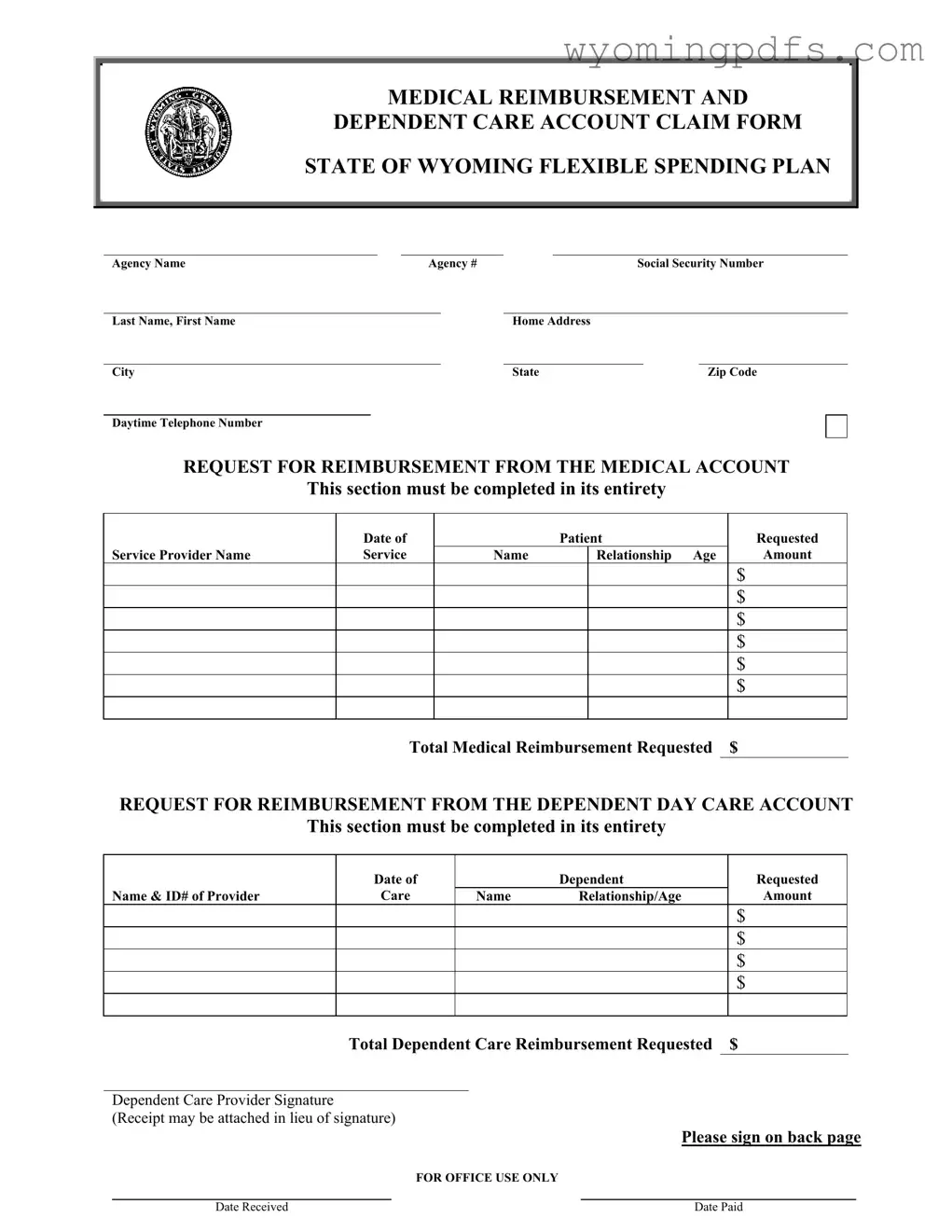

ITEMIZED INVOICES AND AN EXPLANATION OF BENEFITS FROM INSURANCE COMPANY MUST BE ATTACHED.

GENERAL

Requests for reimbursement may be submitted at any time. Semi-monthly reimbursement will be made directly to you. Reimbursement checks will be issued two times during the month (see the current reimbursement claims processing schedule).

If you apply for reimbursement of expenses that the IRS later determines to be ineligible, those reimbursements may be taxed as ordinary income and IRS penalties may apply. Similar treatment may apply to overpayment of reimbursed expenses that have already been reimbursed from some other source.

MEDICAL REIMBURSEMENT

Eligible expenses are qualified medical/dental expenses of the employee, spouse, and dependent(s) that are not eligible for reimbursement from any other source. Expenses that are eligible for reimbursement under a health insurance plan should not, for example, be included on this form. A list of typical IRS approved medical/dental expenses is documented in your Flexible Benefit Plan Summary. General information on the Employee Reimbursement Accounts as well as claims status may be obtained by contacting the Employees’ Group Insurance Office at 777-6835 or 1-800-891-9241.

I request reimbursement from the Employee Reimbursement Account(s) for the expenses itemized above. I hereby certify that I have read and understand the guidelines on this form and that these expenses must qualify for reimbursement under the Internal Revenue Code as outlined on the form.

I further certify that these expenses are not eligible for reimbursement from any other source. I also understand that reimbursement expenses cannot be claimed as credits or deductions on my personal tax return.

DEPENDENT DAY CARE REIMBURSEMENT

Expenses to provide care for your eligible dependents may qualify for reimbursement. Eligible dependents include children under age 13, a disabled child, a disabled spouse, or a dependent disabled parent.

To be eligible, you must be working while your dependents receive care. Also, if you are married, your spouse must be:

−A wage earner, or

−A full-time student for at least 5 months during the year, or

−Disabled and unable to provide for his or her own care.

Expenses eligible for reimbursement are those incurred to enable you to be gainfully employed, and include covered charges by:

−Licensed nursery schools and day care centers

−Individual – other than your dependents – who provide care for your children in or outside your home, or for your disabled spouse or dependent parent in your home.

−Housekeepers, maids or cooks in your home, to include their food and lodging in your home, as long as their services are performed for the benefit of your eligible dependent(s).

Under IRS Regulations, qualified individuals can receive a tax credit for dependent care costs. This credit is claimed on your personal tax return. You CANNOT claim the tax credit for any dependent care costs reimbursed from the Employee Reimbursement Account.